🚨 Crypto Startups Seeking Bank Charters: Innovation or Instability?

A recent Bloomberg Opinion spotlighted deep-pocketed crypto firms like Circle, Ripple, BitGo, and Erebor, all reportedly applying for U.S. trust-bank licenses. While these charters promise access to deposit-taking, lending, and payments infrastructure, financial analysts are sounding alarms that such moves echo the Silicon Valley Bank (SVB) collapse—raising risks of concentrated exposure and sudden runs (livemint.com).

1. 🎯 Why Crypto Firms Want Banking Licenses

Crypto startups aim to bridge the gap between financial innovation and mainstream services:

-

End-to-end financial services: No more dependency on third-party banks for fiat transactions, lending, or custody—self-owned infrastructure becomes feasible.

-

Regulatory legitimacy & trust: A charter can confer stability and credibility in a skeptical environment.

-

Policy tailwinds: Under the current U.S. administration, regulators are actively encouraging new bank formations to fuel innovation and economic growth (en.wikipedia.org, reuters.com).

2. ⚠️ Déjà Vu: The SVB–Signature–Silvergate Saga

SVB’s Collapse

SVB fell victim to a liquidity crisis fueled by a sudden withdrawal of deposits from tech startups and venture capital clients when rates rose, leading to insolvency.

Crypto-Focused Banks Crumbling

-

Silvergate Bank—once a crypto pioneer—collapsed in early 2023 after its digital-asset-driven deposit base evaporated following the FTX collapse (en.wikipedia.org).

-

Signature Bank imploded under similar pressure, with crypto deposits making up 30% of its base and contributing to systemic risk (en.wikipedia.org).

The pattern is clear: high concentration in volatile deposits, regulatory vulnerability, and fragile risk controls .

3. 🏦 Who’s Entering the Fray?

| Firm | Charter Seeker | Role in Crypto |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

| Anchorage DB | Already chartered (2021) | Trusted crypto bank pioneer (livemint.com) |

These firms aim to offer integrated crypto-fiat services—potentially simplifying user experiences but inheriting the full spectrum of banking risks.

4. 🧩 Structural Weaknesses: What’s the Worry?

Experts like Yale’s Steven Kelly and Chicago Fed’s Jonathan Rose point to recurring systemic flaws:

-

Deposit concentration: Heavy reliance on single sectors—like startups or crypto—makes liquidity vulnerable to contagion.

-

Funding fragility: Minimal retail or institutionally diversified funding leaves banks exposed to panics.

-

Weak risk frameworks: Rapid growth without robust liquidity or interest-rate risk management invites failure (onesafe.io, en.wikipedia.org).

Without proper guardrails—deposit caps, liquidity buffers—these firms may fall into the SVB trap all over again.

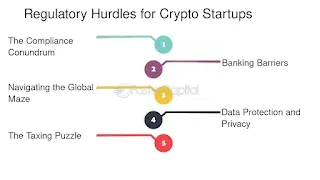

5. 🌐 Regulatory Landscape—Encouragement Meets Caution

-

Regulatory support: The White House and OCC have expressed openness to new fintech and crypto banking models, easing charter approvals (reuters.com).

-

Banking community's caution: Major banks like JPMorgan and Bank of America are proceeding steadily, not recklessly—opting for pilot programs in custody and stablecoins while highlighting compliance concerns (reuters.com).

-

System risk warnings: Federal Reserve officials have highlighted the potential for crypto banking to pose wider financial-system threats if not managed carefully (axios.com).

6. 🔍 Implications for Stakeholders

📈 Investors & Customers

-

Diversify deposits: Don’t park all funds in crypto-driven banks—consider traditional banks or stable funding options.

-

Demand clarity: Scrutinize liquidity models and contingency plans in these emerging banks.

-

Know the volatility: Understand how interest rates and crypto slumps can trigger deposit runs.

🏛️ Regulators & Policymakers

-

Enforce deposit limits: Cap industry-specific deposits to curb systemic exposure.

-

Stress testing: Mandate liquidity and interest rate resilience for crypto-chartered banks.

-

Transparency is key: Spell out risks and compliance expectations upfront to avoid regulatory ambiguity.

7. ⭐ Final Take: A Place for Crypto Banks—With Caution

Crypto startups don’t have to shun banking—or the benefits it brings—but must acknowledge the inherent liabilities:

-

Past failures prove that without diversification, strong risk controls, and oversight, instability is almost inevitable.

-

If regulators champion innovation, they must shape standards that ensure stability—or risk a repeat of 2023's turmoil.

Charters alone won’t fix structural vulnerabilities—but carefully designed, well-resourced, and regulated crypto banks might just lead the next wave of financial innovation.

💬 Discussion Questions

-

Should crypto firms really hold banking charters—or is hybrid fintech licensing safer?

-

What risk controls are non-negotiable to prevent a crypto-focused bank failure?

-

Can regulators foster innovation while avoiding the same mistakes of yesteryear?

Let’s unpack this!

Disclaimer: This is informational content only—not financial or regulatory advice. Always assess individual risk carefully.

Comments

Post a Comment